Make a donation

A strong act of commitment

Donation is a contract* by which you transfer real or personal property, a sum of money or a work of art during your lifetime. When you make a donation to the MSF Foundation, you can be sure that the funds paid will contribute to the financing of innovations in humanitarian medicine.

*A donation must be certified by a notary

Personalised assistance

Like any transfer of assets, a donation needs to be carefully considered and requires advice and expertise. We can assist you in this process. Do no hesitate to contact Catherine Béchereau, your philanthropy advisor. She will answer all your questions and can assist you in your reflection. Naturally, all your discussions will remain confidential and will not entail any commitment on your part.

Catherine Béchereau – Tel: 01 40 21 56 88 or email: [email protected]

There are various forms of support

- Donation in full ownership

This is the simplest form of donation. You donate the entirety of an asset to the MSF Foundation and your donation takes effect immediately. This donation represents a significant tax benefit, because the property removed from your tax calculation base reduces your income tax. If the asset is a property asset, your property wealth tax is also reduced accordingly.

- Temporary donation of usufruct

You remain the owner of your asset, but the income it generates is donated to the MSF Foundation. This donation is granted for a limited period and for a minimum of 3 years. At the end of the agreed period, you will recover full ownership of your property. This temporary donation allows you to reduce your taxable income and benefit from an income tax cut. If you are subject to Property Wealth Tax (IFI), the property concerned by the donation is removed from the IFI calculation base, which is thereby reduced for the whole duration of the donation.

- Donation on inheritance

You can support the MSF Foundation by a gift on all or part of an inherited estate. You thus gift a property or a sum received in an inheritance. You then benefit from a reduction in death duties, because the amount paid is deducted before the calculation of these duties. This is particularly advantageous if you inherit from a distant relative, because the death duties are very high in such cases.

There is no upper limit on the amount of the gift made. The gift must imperatively be made within six months of the death of the relative from whom you inherit.

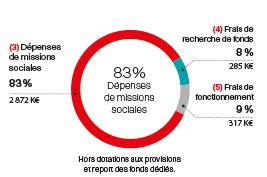

Being transparent about the way we spend your gifts

All gifts finance all our activities, and every year our financial statements are audited by a statutory auditor who checks the accuracy of the information. They are then sent to our donors, for the sake of financial transparency.

-

-

The donor must an adult, sound of mind (Art. 901 of the French Civil Code) and under 80 years old. The donation must not affect the compulsory share, i.e. the minimum share, set aside for certain heirs – referred to as the “compulsory heirs” – in your estate.

-

Your donation may concern a sum of money, a jewellery item, a collector’s item, shares, bonds, royalties, an apartment, etc.

-

Donation is an act which must be carefully considered because you transfer your property during your lifetime in an immediate and irrevocable way.