Make a gift

Isabel Corthier/MSF

MSF hospital, Doro refugee camp, Maban County, South Sudan.

Tom Barnes

Make your generosity count

Thanks to gifts from people like you, we have been able to develop tools to monitor epidemics, allow amputees to regain mobility and autonomy, create a laboratory which can be transported onto our fields of intervention… and also facilitate skills development among MSF staff.

A special relationship with our donors

Within the MSF Foundation we are very careful to create a close relationship with our donors. We would like to involve you in all the projects we support and develop.

- We share our governance with you

Our assembly of donors and benefactors elect a college consisting of three members, representing the assembly on the Board of Directors of the MSF Foundation, every three years. These members, by participating in the governance, are associated with the Foundation’s policies and the measurement of their impact.

-

We invite you to take part in discussions concerning humanitarian medicine organised on the initiative of the Centre for Reflection on Humanitarian Action and Knowledge (CRASH).

Make your tax meaningful

The MSF Foundation is recognised as being in the public interest. As such, it is entitled to collect gifts deductible from property wealth tax and income tax.

- Invest your IFI (property wealth tax) in tomorrow’s humanitarian medicine

IFI (Property Wealth Tax), which came into force on the 1st of January 2018, concerns people holding net property assets worth more than 1.3 million Euros. If you are subject to Property Wealth Tax, 75 % of the amount of your gift is deductible from this tax within the limit of a reduction of €50,000.

By supporting the MSF Foundation’s projects, you can benefit from a tax reduction based on the value of your property assets.

Your gift will serve to support research and development and the implementation of new tools and new practices which will help to create tomorrow’s humanitarian medicine.

- To calculate the amount of your donation

For IFI, we provide you with a calculator. This will enable you to calculate the gift amount which will best optimize your tax. To learn more and find the answers to any questions you may have, go to our dedicated page.

You can also deduct your gifts from your income tax

For Income Tax, you benefit from a tax reduction equivalent to 66 % of the amount of your gift, within the limit of 20 % of your net taxable income.

For example: With a gift of 1,000 €, you benefit from an income tax deduction of 660 €. Your gift costs you 340 €.

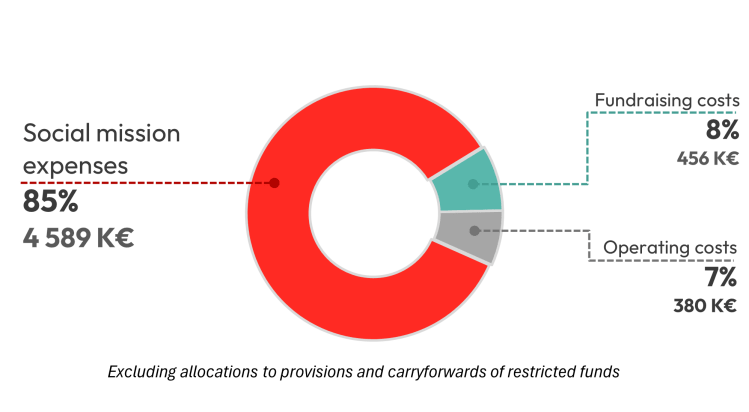

Being transparent about the way we spend your gifts

All gifts finance all our activities, and every year our financial statements are audited by a statutory auditor who checks the accuracy of the information. They are then sent to our donors, for the sake of financial transparency.

Patrick Meinhardt

Make a gift of securities

Do you have a share portfolio and want to support the MSF Foundation? You can choose to make a gift of securities to us. To do this, simply contact Nikki Wodehouse, your philanthropy advisor. She will study with you the solution best suited to your situation and will send you the necessary documents to enable you to transfer your gift to the MSF Foundation’s account.

Upon receiving your securities, we draw up your tax receipt based on the amount of your gift and sell the securities rapidly to finance our projects.

Regarding donation, you often ask us

-

It’s very simple. You can make your gift in several ways:

- directly on our site by clicking here- by a cheque made out to the MSF Foundation and sent to the following address:

Fondation MSF, Service Donateurs, 14-34 avenue Jean Jaurès, 75019 Paris

-

We make every effort to issue tax receipts as quickly as possible. It generally takes two weeks from the date of receiving your gift to issue your tax receipt.

You can also print out your tax receipt from your donor space, here.

As of the 1st of January 2018, you make your IFI declaration at the same time as your income tax return. You no longer have to attach your tax receipts when sending your declaration by post or via the Internet. However, we advise you to keep them because you must be able to produce documentary proof of your gifts upon request by the tax department.

-

TECHNOLOGICAL INNOVATION: in regions affected by a conflict or which are hard to access, we rely on 3D technology to design and print prosthetics adapted to the needs of our patients who have lost a limb and compression masks for facial burns victims. We are also committing ourselves to the fight against antibiotic resistance by participating in the creation of a transportable laboratory adaptable to the various difficulties encountered in the fields of intervention, in order to acquire better knowledge of pathogens and prescribe antibiotics appropriately. We are also developing Antibiogo, a smartphone application which aims to combat antibiotic resistance in low-resource countries by using artificial intelligence and new technologies. In response to the Covid 19 epidemic, we have also developed two mobile application projects, one in Niger and the other in the Democratic Republic of Congo, to help to combat Coronavirus.

APPLIED MEDICAL RESEARCH: we finance the Epicentre study which aims to prove the effectiveness of fractionation of the vaccine against yellow fever and initiate a large-scale change of practice in the event of an epidemic.

HUMANITARIAN KNOWLEDGE: we award scholarships enabling field managers to take university courses leading to diplomas. The aim is to improve managers’ expertise and thus better prepare them to deal with complex work situations. With the Cooperative Learning Laboratory (LAC) project we seek to free the creativity of operational managers at the head office and in field and encourage the development of collective learning within our association.