J’optimise mon IFI

ELISHA KAZONDE / La Fondation MSF

Diego MENJIBAR

Investissez votre IFI dans la médecine humanitaire de demain

Contribuez dès maintenant à l’avenir de la médecine humanitaire : soutenez La Fondation Médecins Sans Frontières et réduisez votre IFI.

Reconnue d'utilité publique, La Fondation MSF vous permet de bénéficier d'une fiscalité particulièrement avantageuse de l'Impôt sur la Fortune Immobilière (IFI). Vous pouvez bénéficier jusqu’à 75% de réduction de votre IFI dans la limite de 50 000 €.

CALCULEZ VOS AVANTAGES FISCAUX

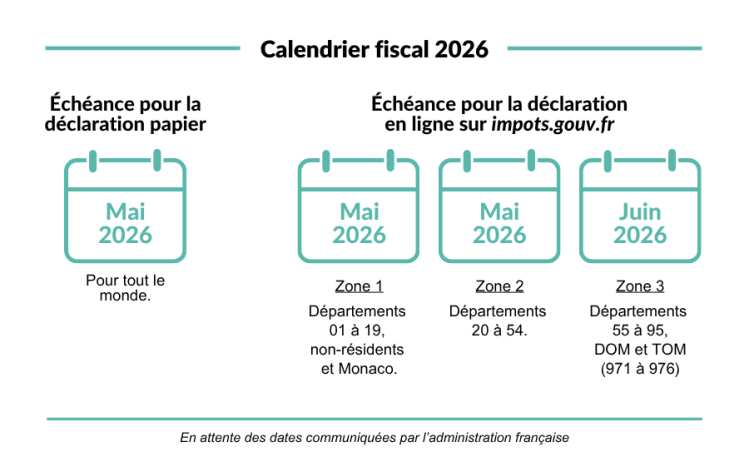

Faites attention à votre date de déclaration

La période de déclaration ouvre en avril 2025, et pour celle-ci vous aurez besoin de remplir le formulaire n° 2042-IFI. Si vous êtes redevable de l’IFI et de l’IR, la date limite de déclaration est la même pour les deux. Toutefois attention les dates de déclaration varient en fonction de votre département de résidence. Vous trouverez le détail de ces dates dans le tableau ci-dessous.

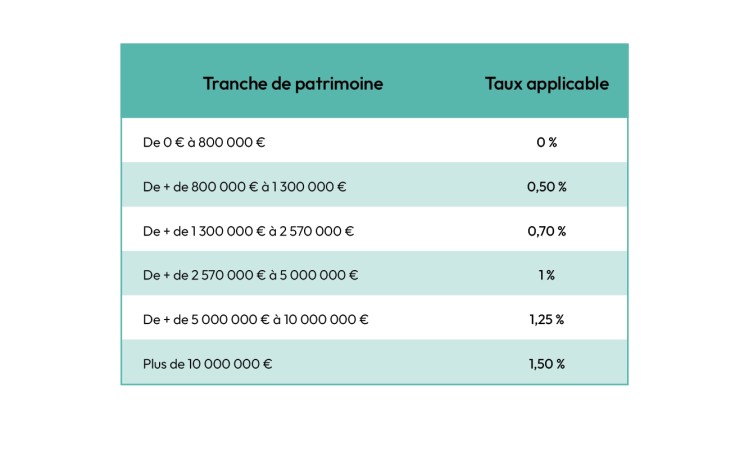

Quel taux d’imposition s’applique à votre patrimoine ?

La valeur de votre patrimoine doit-être supérieure ou égale à 1 300 000 € pour être imposable. À partir de ce seuil, l’imposition est progressive. Le montant de l’IFI est plafonné à 75 % de vos revenus en France et à l’étranger, nets de frais professionnels de l’année précédente (2024 en l’occurrence), après déduction.

Pour connaître votre taux d’imposition, appliquez le barème d’imposition.

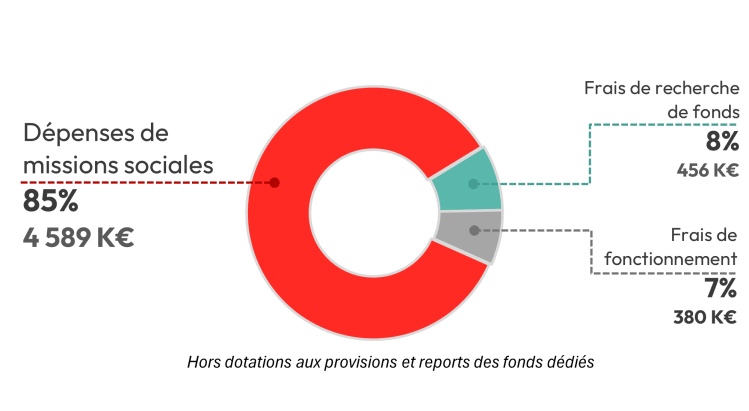

Être transparent sur la manière dont nous dépensons vos dons

Tous les dons financent l’ensemble de nos activités. Chaque année, nos comptes sont soumis à un contrôle par un commissaire aux comptes qui vérifie l’exactitude des informations. Ils sont ensuite envoyés à nos donateurs, dans un souci de transparence financière.

Les questions les plus fréquentes sur l’IFI

-

L’Impôt sur la Fortune Immobilière (IFI) est un impôt français qui s’applique aux personnes dont le patrimoine immobilier net taxable dépasse 1,3 million d’euros. Il concerne uniquement les biens immobiliers et remplace l’ISF depuis 2018.

L'IFI est calculé sur le patrimoine immobilier net taxable, c’est à dire sur la valeur des biens immobiliers imposables après déduction des dettes, au 1er janvier de l'année.

On entend par patrimoine immobilier : les biens meubles ou immeubles possédés directement ou indirectement par le foyer fiscal du redevable de l’impôt. Ne rentrent pas dans le calcul, les biens totalement ou partiellement exonérés : les biens professionnels, les objets d’art, d’antiquités ou de collection, les bois et forêts ou les parts de groupement forestiers, les titres reçus dans le cadre de souscriptions au capital de PME (sauf s’ils sont déjà exonérés au titre de biens professionnels).

Sont également déduites les dettes, non professionnelles justifiables, à la charge du contribuable au 1er janvier de l’année

-

Vous ne pouvez pas déclarer deux fois l’intégralité du don en cumulant les déductions fiscales, mais vous pouvez répartir votre don entre votre IFI et votre Impôt sur le Revenu. Par exemple, pour un don de 4 000 €, vous pouvez choisir de déduire 2 000 € de votre IFI et 2 000 € de votre impôt sur le revenu.

-

75 % du montant de votre don à La Fondation MSF est déductible de votre IFI, mais le plafond de déduction est de 50 000 €. Ainsi, si vous faites un don de 66 667 €, vous atteignez ce maximum de déduction possible.

-

Si le montant de votre déduction d’Impôt sur la Fortune Immobilière (IFI) dépasse le montant de votre IFI ou le plafond autorisé pour les déductions (qui est de 50 000 €), l’excédent ne peut pas être reporté sur les années suivantes.

En revanche, vous pouvez déclarer une partie de votre don (jusqu’à 66 667 euros) au titre de l’IFI et le solde au titre de l’IR.

-

Vous pouvez faire directement votre don en ligne en cliquant ici, ou par chèque à l’ordre de La Fondation MSF puis vous l’envoyez à l’adresse suivante Fondation MSF- Service Donateurs 14-34 avenue Jean Jaurès, 75019 Paris.

-

Le don doit être effectué avant la date limite de déclaration de l’IFI, qui varie chaque année en fonction du calendrier fiscal (aux environs de fin mai - début juin, cf calendrier ci-dessus). Il est recommandé d’anticiper votre don pour être sûr qu’il soit bien pris en compte.

-

Si votre patrimoine immobilier net taxable est supérieur à 1 300 000 €, vous déclarez votre IFI en même temps que votre Impôt sur le Revenu en remplissant le formulaire 2042 IFI que vous joignez en annexe en indiquant la totalité de vos biens immobiliers.

Par ailleurs, le renseignement de la case 9GI du formulaire déclaratif, relative aux biens exonérés en raison de leur affectation à une activité professionnelle, n’est pas obligatoire.

Vous déclarez le montant de votre patrimoine brut et net taxable ainsi que le montant des versements ouvrant droit à réductions d’impôt dans le cadre 9 de votre déclaration de revenus complémentaire 2042 IFI, au paragraphe « Réduction d’impôt pour des organismes d’intérêt général établis en France » sans joindre ni annexes, ni justificatifs.

Pour bénéficier de votre déduction fiscale sur votre impôt sur le revenu, renseignez le montant de votre don dans la case 7UF de votre déclaration d’impôt. Les dons effectués entre le 1er janvier 2024 et le 31 décembre 2024 seront déductibles de votre impôt sur le revenu en 2025.

Vous n’avez pas besoin de joindre votre reçu fiscal à votre déclaration, il faut simplement le conserver en cas de contrôle.

-

Depuis janvier 2019, l’impôt sur le revenu est directement prélevé sur vos revenus, par l’employeur, la caisse de retraite, Pôle Emploi ou encore l’administration fiscale. Il n’y a plus de décalage entre le calcul de votre impôt et son paiement.

Cas N°1 : vous avez déclaré des dons l’année dernière, l’administration part du principe que vous avez renouvelé le montant de ces dons pour l’année en cours et votre impôt est calculé sur cette base. En fonction du montant que vous déclarerez votre réduction d’impôt sera régularisée.

Dès la mi-janvier 2025, vous percevrez un acompte de 60 % du montant de la réduction d’impôts dont vous bénéficiez au titre des dons effectués en 2024. Le reste vous sera versé ou sera régularisé à l’été 2025, sur la base de votre déclaration de revenus 2024 (que vous remplirez en mai 2025 et où vous déclarerez vos dons effectués en 2024).

Cas N°2 : vous faites un don pour la première fois cette année. Vous faites votre déclaration en mai et vous indiquez le montant versé à La Fondation MSF. L’administration vous reversera le trop-perçu l’été suivant votre déclaration (en 2025 pour les dons versés en 2024).