Optimise your IFI

© ELISHA KAZONDE / La Fondation MSF

Diego MENJIBAR

Invest your IFI in tomorrow’s humanitarian medicine

Contribute now to the future of humanitarian medicine : support the MSF Foundation and reduce your IFI.

Recognised as being in the public interest, the MSF Foundation allows you to receive particularly advantageous tax benefits in terms of Property Wealth Tax (IFI). You can benefit from a reduction of up to 75 % in your IFI within the limit of 50,000 €.

Evaluate the amount of the gift to reduce your IFI as much as possible

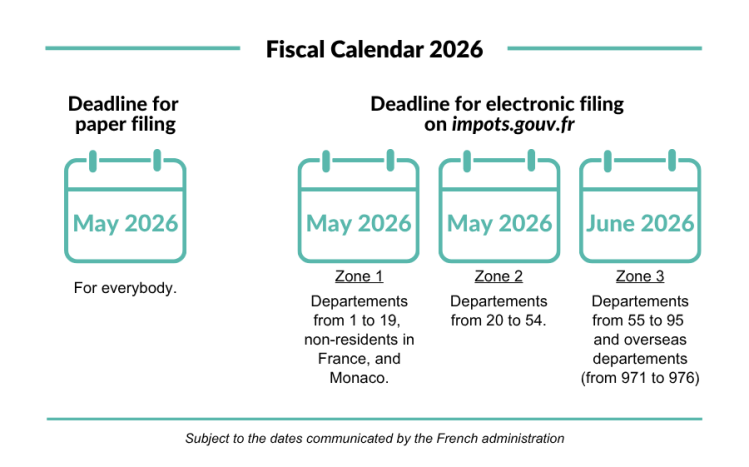

Be careful of your declaration date

The declaration period opens in April 2025, and for this you will need to fill out form no. 2042-IFI. If you are liable for IFI and IR, the declaration deadline is the same for both. However, be careful, the declaration dates vary depending on your department of residence. You will find the details of these dates in the table below.

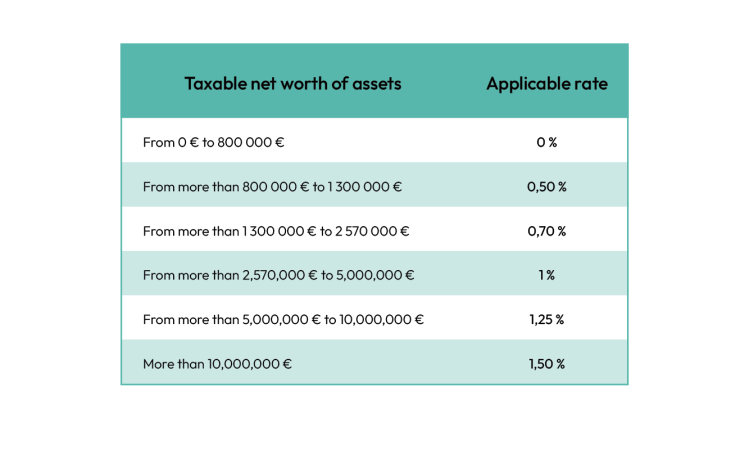

What tax rate applies to your assets?

The value of your assets must be greater than or equal to €1,300,000 to be taxable. Above this threshold, the tax rate is progressive. The amount of IFI is limited to 75 % of your income in France and abroad, net of the previous year’s professional expenses (2024 in this instance), after deduction.

To find out your tax rate, apply the following tax scale.

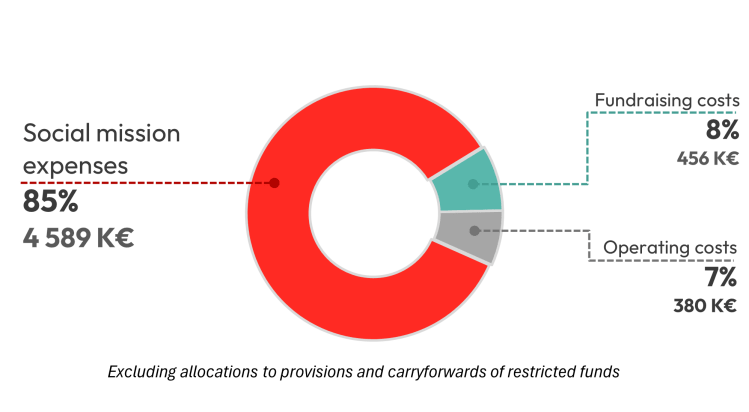

Being transparent about the way we spend your gifts

All gifts finance all our activities, and every year our financial statements are audited by a statutory auditor who checks the accuracy of the information. They are then sent to our donors, for the sake of financial transparency.

Questions most frequently asked about IFI

-

You can reduce your tax and even bring your IFI down to zero by making a gift to a foundation which is recognised as being in the public interest such as the MSF Foundation, if you remain within the limit of the deduction ceiling of 50,000 €. The calculation to be made is easy. You must divide the amount of your Property Wealth Tax by 0.75. For example, if you have to pay 1,500 € in Property Wealth Tax, you can deduct your tax totally by making a gift of 2,000 €.

-

Case no. 1 : you declared gifts last year. The administration assumes that you have donated the same amounts for the current year and your tax is calculated on this basis. Your tax reduction will be adjusted according to the amount you declare.

On the 15th of January 2025, you will receive an advance of 60 % of the amount of the tax reduction from which you benefit for gifts made in 2024. The rest will be paid to you or will be adjusted in the summer of 2025, based on your 2024 tax return (which you will fill out in May 2025 and in which you will declare your gifts made in 2024).

Case no. 2 : you make a gift for the first time this year. You file your tax return in May and indicate the amount paid to the MSF Foundation. The administration will refund the overpaid amount to you in the summer following your declaration (in 2025 for gifts donated in 2024)

-

IFI is calculated on the taxpayer’s net taxable property assets, i.e. on the value of the taxable real estate after deduction of liabilities, on the 1st of January of the year.

Property assets means: movable or immovable property possessed directly or indirectly by the taxpayer’s tax household. The calculation does not include totally or partially exempted property: professional property, works of art, antiquities or collectors’ items, woods and forests or shares in forestry groups, securities received in connection with subscriptions to the capital of SMEs (unless they are already exempted as professional property).

Justifiable non-professional liabilities payable by the taxpayer on the 1st of January of the year are also deducted.

-

All individuals whose property wealth is greater than 1,300,000 € are subject to IFI. You must therefore evaluate your property assets according to their market value on the 1st of January 2025 : buildings and undeveloped real estate; property assets and rights held in usufruct; property assets and rights under lease finance or rent-to-buy arrangements; securities of companies representing the property owned by these companies.

-

If your net taxable property wealth is greater than 1,300,000 € you make your IFI declaration at the same time as your income tax return by filling in form 2042 IFI which you attach to your statement, indicating all of your property assets.

It should also be noted that filling in box 9GI of the declaration form, concerning property exempted due to its assignment to professional activity, is not mandatory.

As of the 1st of January 2018, whatever the amount of your assets, you make your IFI declaration at the same time as you fill out your income tax return. You declare the amount of your gross and net taxable assets together with the amount of the payments entitling you to tax reductions in box 9 of your supplementary income tax return 2042 IFI, in the section entitled “Tax reduction for public interest organisations operating in France”, without attaching any annexes or supporting documents. For further information, refer to www.impots.gouv.fr